March 30, 2023

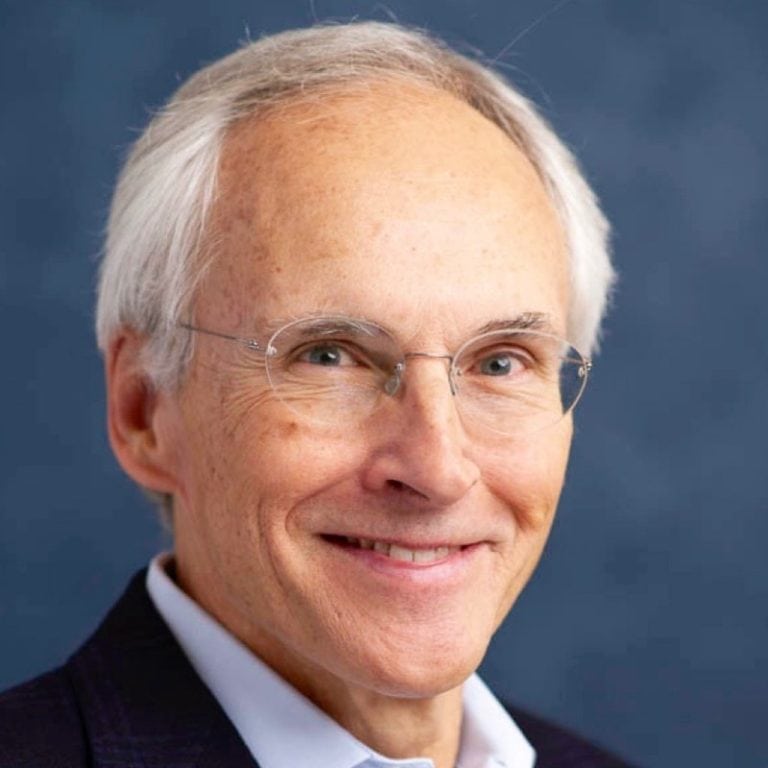

Sasan Goodarzi, CEO of Intuit, Atlassian Board Member

Rebooting Fintech With AI – Sasan Goodarzi, Intuit

As tax season hits its peak, and Intuit’s (NASDAQ:INTU) customers scramble to meet deadlines across the globe, the company is rebooting itself to leverage technologies that will make it easier.

This Silicon Valley based trusted technology platform provider has carved out a rather large niche, helping 100 million consumers and small businesses manage their most pressing financial challenges.

With over 17,000 employees delivering $12B in revenue, Intuit recently celebrated its 30-year listing anniversary on NASDAQ—and continues to expand beyond TurboTax and QuickBooks—so far adding new products, services, brands and ventures to the portfolio, like Credit Karma, MailChimp, and Mint.

After a Core Reboot was initiated four years ago, they began to focus on building the next-generation AI enabled capabilities—transitioning from customers doing most of the work to an AI generative platform that does work for customers. They seem to be hitting on the big three cylinders I look for in smart growth/innovation BBB reboots: Building (R&D) their own new tech./capabilities, Buying (acquiring), Borrowing (partnering).

Leading that charge is Intuit’s CEO, Sasan Goodarzi. An electrical engineer by background, and a Kellogg/Northwestern MBA, Sasan serves on the board of directors at Intuit and Atlassian.

Sasan joined me for an episode of the Reboot Chronicles to take an inside look at how they have developed their growth, innovation, product and service roadmaps—and how it may position them strategically in a Crypto/Web3 world.

Building The Future Of AI with The Power Of Data

With all the hype about leveraging generative AI, like Open AI’s ChatGPT, many companies—even Google and Facebook—are frantically scrambling to deploy it before it disrupts them.

Since Sassan and his team decided to build an AI expert driven platform as part of its Core Reboot, they were ready for the coming data revolution with BBB investments in three key areas: Machine Learning (ML), Knowledge Engineering (KE), Natural Language Processing (NLP). Technology is driving this sector.

Speaking of data, Intuit announced the launch of its Intuit Quickbooks Small Business Index, a monthly measure indicative of small business employment and hiring in the U.S, Canada and U.K. This was developed in collaboration with leading University of Chicago economist, Professor Ufuk Akcigit and other international team of economists led by him to shine light on small businesses and propel their growth.”

Small businesses are really consumers, who made a choice to be entrepreneurs and go into business for themselves. “The problem we are focused on for them is to help them really manage their cash flow. If you start with that context in terms of what’s most important that we’re trying to solve for our customers, and that we have the privilege & the obligation to manage the data for our customers, we have about 55,000 data attributes per consumer. We have almost 400,000 financial attributes per small business.” That’s Big Data!

“For a small business, we see all of your money coming in. We see the customers that you serve, we see the vendors that you serve. We see all the employees that you have. So there’s a lot of data that we have access to. We leverage that data to really help them make decisions, and succeed. For consumers, it’s to help them find ways to improve their credit score, to be able to save money, to be able to pay the right bills on time, and to really just achieve prosperity, which is ultimately our mission.”

Growth and Innovation Secret Sauce

Trust is a major component when it comes to a 100 million people housing massive amounts of data with one source, from sinking bank accounts to so many other attributes, and letting Intuit fuel their success leveraging that data repository. Not letting success impede further scaling, and staving off slow progress is one of the toughest things to execute for many companies.

“Velocity is a important leadership decision and choice. A company of our size & scale can use speed to our advantage. It can also be the thing that completely slows us down. I don’t think you can just say let’s go fast without being intentional about it. For us, there’s a mindset element, there is a process element, and then there is a technology element. From a mindset perspective, we often talk about what we call a day one mindset, which is, every day is day one. The curiosity that you have, the questions that you ask, the search that you have for what’s blocking the team, the impact that you want to make is all about speed, impact & velocity. We train our leaders on process.

One example is our general philosophy around our decision framework – most decisions are two-way doors, meaning that you can empower the teams closest to the work to make the decision. And if it was a decision that you don’t love, you can always go back and take a different direction. There’s very few decisions that are what we call one way doors where once you make the decision, you can’t undo it. But it’s a really big decision that could impact the company. So that’s a process.

The third is technology. We have been investing heavily in making sure that all of our services are sort of one that self-help, so you can access the service that you want to making sure all of our technology is modular, so teams can leverage the services that they need and not get into our meetings. And then we measure our code deployment. Some companies say that’s great, some companies don’t like it. We think it’s important if you use it the right way. Twice a year we measure the engagement of our employees and there are many sub elements like how fast it can move, how fast decisions get made, do they feel like they’re delivering for customers versus spending time in meetings, & so we have a quantitative way of really understanding how our employees feel – just to unlock moving faster as a company.”

Borrowing takes a certain execution skill to partner with all type an sizes of companies, from stealth AI startups to vertical players and even the likes of Amazon Web Services (AWS). AWS is not just hosting Intuit—they are also leveraging Amazon SageMaker as a core element (combining AI with ML) to yield a whopping 1.3 million hours savings in receipt processing for Intuit customers. Time is money—especially for and SMB.

Balancing Build Buy Borrow

Hitting on all three cylinders to continue growing is a challenge in itself and reflects on the culture that Intuit as a company has built for itself.

“We believe the durability of our company will come from innovating from within. If you try to partner your way to every answer or buy your way to every answer, you’re not going to have a company that has the DNA of innovation. So our first and foremost focus is, what are the customer problems that we’re trying to solve, and how do we allocate our capital towards innovating within and building the strength of our innovation within. Our advantage, really comes from data and the application of A.I. to that data to really ignite innovation internally. We will always look to understand if there are problems that we can solve for our customers with partners and or acquisitions. And I think noteworthy ones are both Credit Karma and MailChimp. The reason we chose to make those acquisitions is, it probably would have taken us based on the assessment that we did, about five plus years to build some of those capabilities.”

As a trusted governance partner for many small businesses, Intuit has a broad range of customers—from hairstyling to plumbing to construction and insurance companies. “In order to be able to do that, we really have to solve the most important problems horizontally and also have a platform with APIs that if a small business, depending on their size, wants to have a certain application that is very critical for insurance or for plumbing, that they can in essence go get that off of our app store. It’s about horizontally solving the problem, leveraging our platform play, but at the same time making sure that we can provide very specific vertical problems that we can solve for our customers. And that’s really an important method to the success that we’ve seen for our customers.”

As for marching ahead serving customers in more meaningful and effective ways, “I believe that we are at the beginning of the next landfill curve in a positive way. AI In our case – it’s changing the industry from the innovation that’s now possible, & that wasn’t before. Fundamentally, it’s giving us the ability to go from building platform capabilities so the customers can do the work, to platform capabilities where we do the work for the customer and propose decisions for them. That coupled with blockchain and decentralized technologies, which is really for us all about eliminating the time from sending money and getting money, is world changing for our customers. Given all of the capabilities of Web3, our focus is how do you leverage those technologies to be there for the customer and really never losing sight of the customer problems.”