July 1, 2020

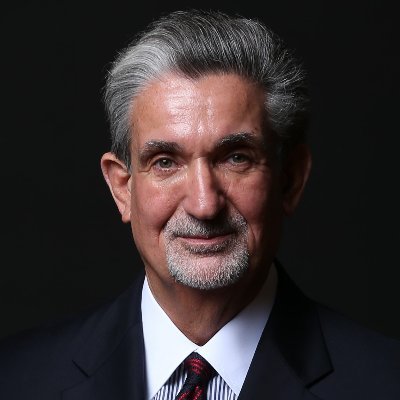

Ann Winblad, Co-founder & Managing Director, Hummer Winblad Venture Partners

I took a look at the Software/SaaS market on The Reboot Chronicles with the most thoughtful venture capitalist I know, Co-Founder and Managing Director of Hummer Winbald Venture Partners, Ann Winbald. We covered a lot including:

Humble Beginnings

Ann is a VC pioneer starting one of the first funds to only focus on software during the tough times of the late 80’s, bad timing. She had around 130 investor meetings where she was consistently turned down, but she persisted. Thirty years later she has launched almost two-hundred software companies, with hundreds of investments, and dozens of successful exits and IPO’s. Ann is a hands on investor who enjoys getting to know an entrepreneur, on a personal level, and participates in numerous lunches on a weekly basis. COVID has put a dent in this approach, but she is still looking at a record number of companies to fund and help scale.

2020 Digital Transformation Final Exam

We talked about what’s hot and what’s next and what 2020 is doing for demand. It is clear, now more than ever companies / large enterprises are accelerating digital. This renewed interest in all things digital is providing a global opportunity for startups and investments across the enterprise software space, including supply chain, engagement platforms and digital operations.

Evaluating an Investment Through VC Eyes

Does the business idea make sense, is it solving for the right pain point and does the company have the right CEO to lead? If the answers are yes to all three questions, then a VC will be more interested in your business. Recently, Ann invested in Smart Access, this Ontario business that brings automation to “deskless workers”. These are workers on the manufacturing or distribution floor that are disconnected, keep an eye on that one. Another investment I liked was Mulesoft, which was a huge success, and IPO and a multi-billion dollar exit to Salesforce. Her company generally targets startups with less than ten employees, Mulesoft only had five.

What’s Should Entrepreneurs do Now

Entrepreneurs will be wise to consult with other entrepreneurs who have successfully raised money. Tell stories, learn from each other and share best practice tips. Don’t retreat in the downturn, polish your strategy, pivot into the next-normal with a new or leading position where you can add more value. She doesn’t invest in products, so build a great company and team around a product. And be patient for the yes, venture capital firms take their time…it’s a fast NO and a slow YES.