Dean DeBiase is a best-selling author and Forbes Contributor reporting on how global leaders and CEOs are rebooting everything from growth, innovation, and technology to talent, culture, competitiveness, and governance across industries and societies.

Rebooting The EV Auto Industry

By Dean DeBiase

May 4th, 2023

Have you tried to buy a car in the last year? Its not much fun.

With limited inventories to choose from, it has not been an enjoyable consumer experience. Actually, it’s been a rough and dicey few years for the automotive industry as a whole.

Why? The COVID-19 pandemic delivered a short, sharp shock to the sector—global production in 2020 declined 16%, wiping out a decade of growth—and sales of new cars plummeted. But it was the pandemic’s long tail that arguably caused even more problems, as the global shortage of semiconductors left manufacturers unable to meet surging orders and forced to take measures like closing production lines or reducing shifts.

The invasion of Ukraine by Russia, which exported up to 30% of the world’s palladium (a rare metal used for semiconductors) pre-war, further destabilized supply chains, particularly for European OEMs that were doubly hit by a rapid increase in energy prices.

What’s more, these obstacles have come along at a time of significant transformation: an accelerated push for the transition from combustion engines to the mass production and adoption of electric vehicles (EVs). At COP26 in 2021, six major automakers and 30 countries signed a pledge to end the sale of gas and diesel powered cars by 2040, while the European Union looks set to ban their sale by 2035, and the EPA wants as many as two-thirds of all new vehicles sold in the U.S. by 2032 to be electric.

Sound aggressive? It is artificially so. As a student of American business history and free-market innovation, I don’t recall governments outlawing horses to accelerate the natural innovation cycles of the internal combustion engine. These types of stimulants can actually slow development and work against free-market progress.

Perfect Storm

Putting geopolitical views aside, these growth and innovation mandates have sent the automotive industry scrambling into unchartered waters. For the large automotive groups (OEMs), making this change happen means overhauling manufacturing processes, creating new supply chains, developing new expertise in battery technology—as well as investing heavily in research and development and managing an entirely new regulatory framework. And you don’t have to be an industry expert to know that new disruptor brands—led by the likes of Tesla, Rivian and Lucid in the US, and BYD and XPeng in China, are increasingly driving the conversations—having made much of the early-stage EV headway, unencumbered by legacy infrastructures.

It’s understandable, therefore, that legacy manufacturers may feel they’re being closed in on two fronts. On one hand, they’re competing with these electric-first brands, and on the other, they’re having to transform quicker than their corporate cultures are used to chugging along at. Everything from their suppliers, design and manufacturing processes to business models, IP and ecosystem management must be shifted toward emerging EV platforms—all while maximizing profits from their traditional models. Ugh, a perfect storm indeed.

With this double whammy (and more), it’s clear that if a legacy manufacturer wants to come out of this storm successfully, they will need to do more than hire the usual consultants, promising investors to become more agile and innovative. That used to cut it—but not now. It is more than a transformation—it is what I call a Core Reboot because it systemically shifts a company (or sector), whether it is ready or not. Companies in many sectors have faced this—and the ones that made it made the bolder moves.

Dancing With Startups

I run a program, that I also teach at Kellogg/Northwestern, called Dancing with Startups, which helps large corporations reboot their businesses by enabling and tapping into entrepreneurial mindsets, partnerships and ecosystems. The favorite level of the program is “ Separating from the Mothership”, which develops entirely separate businesses to not just act like a startup, but improve their chances of success and market domination. Two companies doing this are Ford (F) and Volkswagen’s (VWAGY) SEAT (pronounced “Say- At”) group.

Ford‘s Big Bets

As GM deals with the pain of sunsetting its first generation Volt, Ford is shifting the company toward its second-generation EV platform. I think Ford gets the power of separating from the legacy mothership, investing billions into EV’s, with their Model E group and a bold innovative plant in BlueOval City, Tennessee. More than a facility, the $5.6 billion mega-complex will be Ford’s largest bet yet. They are treating the Model E group as a startup and the, still under wraps, ‘T3’ EV truck (code name) promises to reboot the company and the market, with trucks rolling out in about two years. Jim Farley, Ford president and CEO, has put a competitive stake in the ground saying T3 will be embedding technology capabilities that we have never seen before, “Project T3 is a once-in-a-lifetime opportunity to revolutionize America’s truck…melding 100 years of Ford truck know-how with world-class electric vehicle, software and aerodynamics talent. It will be a platform for endless innovation and capability.” I’ve always owned GM SUV and truck brands, but what’s purportedly being built Tennessee could convert me in 2025.

I took a look under the hood of another emerging EV brand, SEAT, the biggest automotive company in Spain, which is Europe’s second-largest car producer behind Germany. Based in Martorell, just outside Barcelona, the company has been around for decades and has become the country’s flagship brand before becoming a wholly owned subsidiary of the Volkswagen Group in the eighties.

A low-margin/high volume brand in a large group, SEAT is far from immune to the disruption blowing through the automotive industry. I talked with Wayne Griffiths, a Volkswagen Group lifer, who took over as SEAT’s CEO in 2020, knowing that he needed to shake things up in order to reboot the company.

A fellow walk-the-talk believer in startup mentality transformation, I like his blunt observations, “SEAT is a company with a great history, but it must keep up with the times and transform itself. All the industry players that choose to defend the status quo will lose in the long run. The companies without the courage to explore new horizons and transform themselves will disappear.”

Griffiths decided to do something radical, that I don’t recommend for faint of heart leaders—a double reboot. These moves not only set SEAT on the path to developing sustainable EV production capabilities, but also took the unprecedented step of creating and launching an entirely new brand within the Volkswagen Group.

Not Your Father’s EV

The cards are being reshuffled and the kids are in charge. As Griffiths puts it, “Disruption through electrification means that auto brands no longer need history or heritage. The new generation of young people are looking for different answers, brands that their parents and grandparents didn’t drive.”

In 2018, SEAT launched CUPRA, a new, standalone brand designed to help the company access both a new audience and price point, pitched between them and premium brands like Audi. They identified a gap in the market for EVs that were marketed differently from the lean-back, tech-first brand experiences of a Tesla or Polestar. I think CUPRAs stand out from much of the (somewhat boring) EV market’s utilitarian design. Now the fastest growing brand in Europe, the brand, has sold over 300,000 cars, and hit a record 46,500 sales in Q1 2023.

“We make cars that not everyone likes but that some people love—the provocative design is part of that,” Griffiths explains. “Everything in our cars is centered on the driver – we are proving that EVs don’t have to be boring, and the driver experience is so important here.”

Launching a brand at a higher price point means increased margins, which hopefully leaves a company like SEAT better placed to withstand headwinds like supply chain issues, increased energy and raw materials prices, and unforeseen global events.

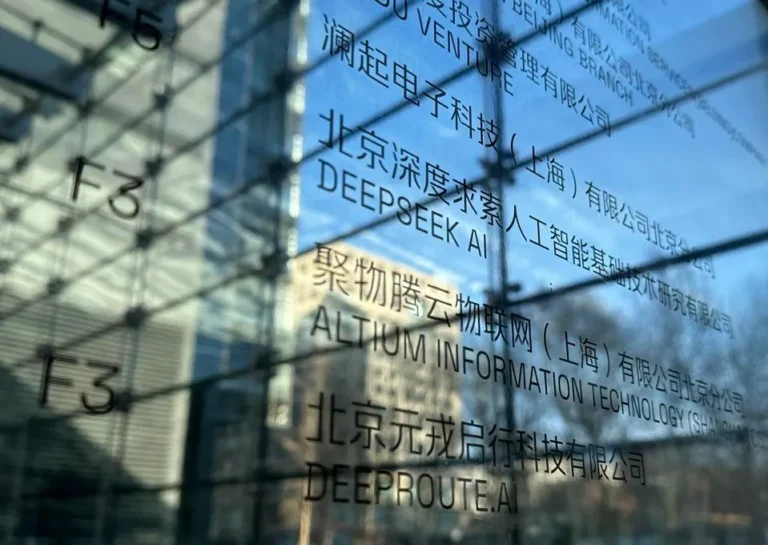

As Ford has learned, rebooting the brand is only the beginning. In 2022, SEAT, Volkswagen Group and their partners, announced that they were moving ahead with Future: Fast Forward (F3) a countrywide project that will see them investing ten billion euros into Spain’s electrification—a project the U.S. can learn from. Working with the Spanish government, the plan includes transforming SEAT’s Martorell site so that it can make small EVs for Volkswagen Group brands, as well as building a battery gigafactory near Valencia, Spain’s first, just over 200 miles down the coast.

It will be interesting to contrast and compare how the teams and cultures of SEAT’s Martorell and Ford’s BlueOval City site create—from a clean slate—the next generation of transportation. From inspirational design to agile assembly, I think the global industry has a lot to learn and will be able to go-to-school modeling not just the companies—but the connected tissue in the ecosystems being created.

Spain Steps Up As Electromobility Hub

Having secured investment from the Spanish government, F3 can be seen as a response to EV production’s early burst with the western startups and China, as Griffiths sees it, it’s a “move now or lose it forever” situation and letting Spanish auto manufacturing wither away as the market evolves is not an option.

“If Spain had not taken on this role, then others would have—either in eastern Europe or Asia or somewhere else. And if the compact electric car is not made here and now, then it will come from outside Europe relatively quickly,” he says. “It was clear to the government that we had a unique opportunity to bring about this transformation for Spain’s automotive industry far earlier than many expected.”

SEAT and the Volkswagen Group have moved quickly to secure the funding to turn Spain into an electromobility hub containing the entire value chain for the electric vehicle within its borders, protecting it from some of the globalization challenges that have plagued the industry over the past few years. And to tie it all up, the flagship compact electric vehicle planned to roll off the production line in 2025 will be an 100% electric, called the UrbanRebel.

Curve Bending

The price of EVs for the consumer has been one of the main obstacles slowing market development, and no one can say with 100% authority how this industry revolution will play out. As we teach at Kellogg/Northwestern, new products, services, platforms and even industries go through lifecycle curves, from early adopters to mass-market madness.

Normally, competitive sectors increase market penetration by balancing out supply and demand curves—including lower price point options for consumer types. The U.S. government is trying to bend that curve, subsidizing the typically low volume/high price early adoption consumption phases. This, and global competitive market forces (did I mention China) is pushing auto makers to invest billions, despite significant gaps in charging infrastructure, scalable energy generation, and distribution strategies.

Ford’s Farley is looking to make big curve-bending moves to develop EV ecosystems—including mining, processing and production—stating “The big change is going to be to onshore all that capability of processing, but also mining back here in the U.S. It’ll be a huge job, just like it has been for semiconductors.” Bold moves indeed and other OEM’s will need to step up to shape policy in the U.S.

As for SEAT, the company just announced its long under wraps all-electric SUV. Available next year, their Barcelona design and development teams produced a next-gen platform that will that may begin to shift consumer expectations as demand moves toward the mass market. The way that SEAT has refused to sit idly by and let change happen to them, I believe provides growth and innovation lessons for leaders across industries—especially those facing accelerating transformation and disruption.