July 18, 2022

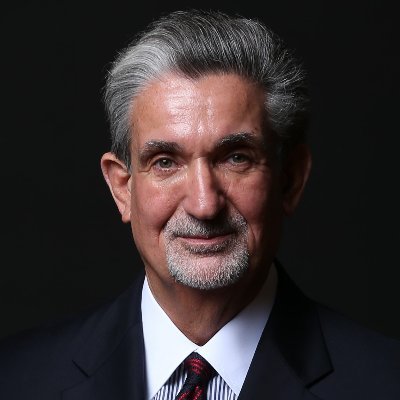

Michael Rubenstein, CEO of Appnexus, Open Store

AI, M&A and Early Ecommerce Exits

The Reboot Chronicles is about organizational, leadership and personal transformations, and my guest on this episode, Michael Rubenstein, co-founder of OpenStore may likely not be known to you yet. But, the work he has done over the years has radically changed advertising and ecommerce. He is someone whose work likely touches everyone in business who does any kind of advertising and is currently helping early-stage ecommerce brands get the early liquidity they may want, and maybe be the next Chewy or Wayfair.

From DoubleClick to AppNexus to OpenStore

Michael honed his skills at DoubleClick, where he was founder and general manager of their ad exchange and stayed with them through their acquisition by Google in 2007 for $3.1 billion. Before advertising exchanges, buying “spots” on TV, radio, print, and even digital was a holdover from the Mad Men world of phone calls, lunches and vast amounts of paperwork. Into this picture stepped DoubleClick that automated the buying of ads online and placed them on an ever expanding “network” of sites. Sellers could feed “inventory” into the system and buyers could place orders and within a day see their ads on their favorite websites. Wall Street sales efficiency entered the advertising world.

Michael’s next move was running AppNexus which upped the ante for this ecosystem by being an exchange of all exchanges and coming up with the concept and the technology to deliver “RTB”: or real time bidding. Just like the automated commodities exchanges of corn and wheat, advertising became a traded commodity. What you may not realize is that the ads you see on digital content (and increasingly streaming video) that appear so relevant to your interests or purchasing habits are bought instantaneously on a bidding basis and matched in that instant to various databases of sales and online activity.

As Michael recounts it: “if you look at the way media was bought and sold on the internet, prior to the advent of programmatic 15 years or so ago, it really looked a lot like the way television or magazine advertising or anything like that have been bought and sold. So the idea of actually putting that model online and using algorithms in real time to tailor media buying decisions was revolutionary. And what started in the early 2000s as an experiment using publisher remnant inventory, has since turned into a movement that has eaten the entire advertising and media buying world. Today the majority of advertising, even in traditional media is being bought and sold using programmatic techniques.”

The short story for AppNexus? ATT bought it in 2018 for $1.6B as a way to stay competitive in the advertising world with Google and Amazon. Having been a CEO of AT&T’s metagames platform myself, which I eventually divested from AT&T and sold to AOL, Michael’s survival story inside the “AT&T Death Star” is inspirational, as he leveraged it to launch his next frontier—AI and ecommerce. Since everyone everywhere seems to think they can sell stuff online, what’s the challenge? As Michael says: “if you look over the last decade or so there’s been an explosion of ecommerce across the world. But in particular, in the long tail of E commerce and platforms like Shopify have facilitated. They taken what previously was Main Street retail entrepreneurship, and made it really easy for online audiences. There are millions of these longtail ecommerce businesses with a business problem: they don’t have access to financing or liquidity.”

Michael’s company OpenStore, co-founded with Keith Rabois, the mastermind behind OpenDoor and the General Partner at Founders Fund, assesses an ecommerce’s company’s Shopify and bank data and in a matter of days (eventually in an hour or so, says Michael) presents an offer for the company. Once again, the heavy lifting is done by algorithms.

As someone who has spent the last 20 years building companies and working within the M & A model, I think this sector is ripe for innovation.